|

| George Masnick Senior Research Fellow |

Population Size

Figure 1 shows population size of five different 10-year birth cohorts. The youngest cohort (born 1979-1988) remained fairly constant in size between 2003 and 2013 at about 41 million. This number is slightly larger than the next oldest cohort (born 1969-1978), but not as big as the cohort born 1959-1968, which includes younger baby boomers.

U.S. immigration law still promotes family re-unification as one of its core principles, and this provision was less impacted by the economic downturn than employment driven immigration, and probably resulted in a more sustained immigration of 35-44 and 45-54 year olds. In addition, undocumented immigrants in these age groups were more likely to have lived here longer and have children born in the U.S., so they were less likely to have left the country during the Great Recession.

From 2003-2013, the two oldest cohorts between age 55-64 and 65-74 lost population due to mortality. The oldest (born 1939-1948) declined by 22 percent and the next oldest (born 1949-1958) lost 11 percent of its population.

Number of Households

Figure 2 shows parallel cohort trends in the number of households produced by the population in Figure 1. Three things are noteworthy. First, most of a cohort’s contribution to household growth occurs as it moves from age group 15-24 to 25-34, as is visible in the sharp upturn in households among the leftmost (youngest) cohort in Figure 2. Second, the cohort born 1969-1978 (red line) appears to have formed fewer households in 2013 at age 35-44 relative to older baby boomers at the same age than its population size might have predicted. The 1969-1978 cohort is not on track to attain the household numbers achieved by the 1959-1968 and 1949-1958 cohorts (green and purple lines). Third, the two oldest cohorts, although having lost a significant share of their populations from mortality, did not reduce their household numbers proportionally.

Lower levels of household formation in the youngest two cohorts when compared to baby boomers are somewhat expected because they contain higher shares of both foreign born and minority native born, each of which have lower rates of forming independent households. They are also cohorts that have experienced delayed marriage and fertility among the native-born non-minority population, making independent household formation for the youngest members of the cohort as a whole even less likely. But if members of these cohorts are simply postponing marriage and family formation, household formation for many is also being postponed, so future upward movement in household trajectories when cohorts are still under age 45 is likely.

The fact that household numbers after age 55 do not drop as quickly as population numbers is because married couples head most households in older age groups, and if one spouse dies, the household generally survives. In addition, divorce in middle and old age generally turns one household into two, partly offsetting deaths that occur to persons who live alone. After age 75, losses from mortality increase dramatically, so it will not be until after 2020 for the oldest baby boomers, and after 2030 for the youngest and largest baby boomer cohort that significant declines in older owner households take place.

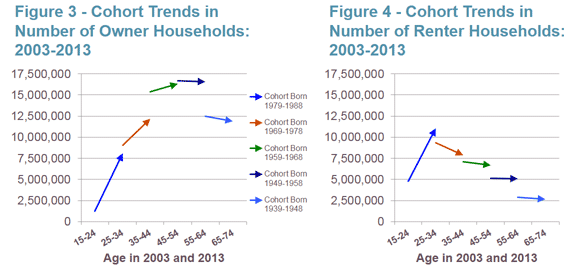

Owner and Renter Household Trends

Decomposing the cohort trends in total household numbers into owners and renters further refines our understanding of the demographic underpinnings of recent household and housing market dynamics. The youngest cohort’s shortfall in household formation, as it moved into the 25-34 age group, was especially severe on the owner side, as shown in Figure 3.

In spite of having a noticeably larger population at age 25-34 compared to the next oldest cohort (red line), and a slightly larger number of total households at the same age, owner households were almost a million fewer. In addition, this next oldest cohort also shows levels of owner household formation well below what was achieved by the cohort born 1959-1968 (green line) when it was age 35-44 in 2003. Finally, the 1959-1968 cohort had slightly fewer owners in 2013 than the next oldest cohort (purple line) at age 45-54 despite having both 4+ million more people and 1.2 million more total households. But we must not lose sight of the fact that the older 1959-1968 and 1949-1958 cohorts aged into their 40s and 50s during a very different economic period (1993-2003) with better income growth, looser mortgage lending standards and more affordable newly built housing. The number of owner households that these older cohorts achieved at ages 25-34, 35-44, and 45-54 might not be a proper benchmark by which to judge the progress of today’s younger cohorts.

Figure 4 shows that in 2013, the number of renters in the youngest cohort at age 25-34 was significantly larger than the number of owners (11 million compared to 8 million). This compares to much greater parity between the number of owners and renters in the next oldest cohort when it was age 25-34. Although the number of owners in the youngest cohort was well below the number of renters in 2013, the increase in owners between 2003 and 2013 was still larger than the increase in renters.

Looking forward, the 1979-1988 cohort is going to add many more owners over the next 10 years, while at the same time its number of renters should decline when the cohort moves between ages 25-34 and 35-44, given historical cohort transitions. In fact, this youngest cohort should continue to add owners and lose renters over the next three decades until it reaches ages 55-64. Of course, the exact numbers of owner additions will be determined by the state of the economy, by income trends, by housing prices and mortgage interest rates, and by lending practices of banks and mortgage companies. To a certain extent, future homeowner numbers will also be determined by future demographic trends in marriage, fertility, immigration and mortality that affect this age group, but these are less likely to involve significant departures from recent historical levels and are more predictable.

By examining the cohort trends in the numbers of population, households, owners and renters in the way we have, we gain a greater appreciation of the degree to which millennials have been slow to form owner households. But we also find that the next older cohort, born 1969-1978, is also well below levels achieved by baby boomers when they were the same ages. There remains room for much upward movement in owner household formation for these two youngest cohorts. However, it is unlikely that these cohorts will ever reach the 16 million owner households achieved by each 10-year baby boomer cohort without significant reductions in the obstacles they now face in becoming and remaining homeowners. Still, we should look forward to continued gains in owner household formation for the two youngest cohorts as they move into their 40s and 50s over the next decade and beyond.

No comments:

Post a Comment