|

|

| by Chris Herbert Managing Director, JCHS |

and by Andrew Jakabovics Sr Director, Policy Development & Research Enterprise Community Partners |

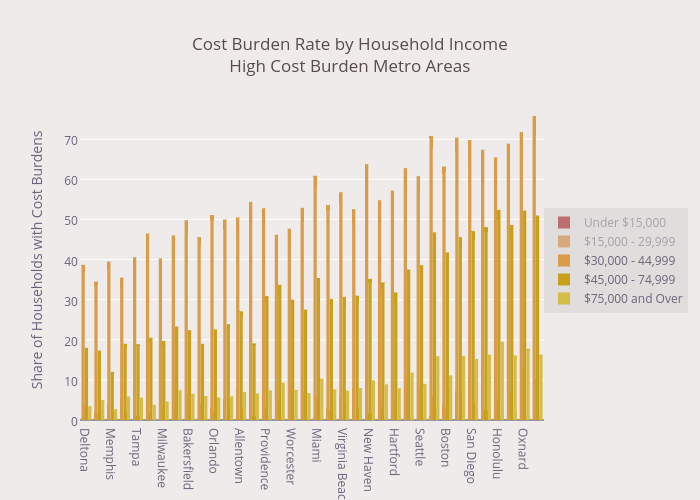

Since the start of the 2000s, the U.S. has seen an astounding growth in severely cost-burdened renters, from 7.0 million in 2000 to 11.3 million in 2013. Several factors have contributed to this growing housing affordability crisis. Over this whole period, rents have been growing faster than incomes, and since the housing crash the homeownership rate has been plunging, producing record growth in renter households. With supply struggling to keep up with demand, rental markets have tightened, further exacerbating affordability challenges. There simply has not been enough affordable rental housing to meet growing needs, particularly among low- and moderate-income households.

Given these troubling trends, Enterprise and the Joint Center set out to assess whether the rising tide of renters struggling to find housing they could afford was likely to abate. The starting point for these projections are Census Bureau population estimates that call for an increase in the adult population in the U.S. of 24.6 million between 2015 and 2025. The Joint Center estimates that the expansion in population will result in the formation of 12.4 million net new households, of which at least 4.2 million will be renters. From these estimates, we then project how many households will be severely rent burdened in 2025 under differing assumptions about real changes in income and rent levels.

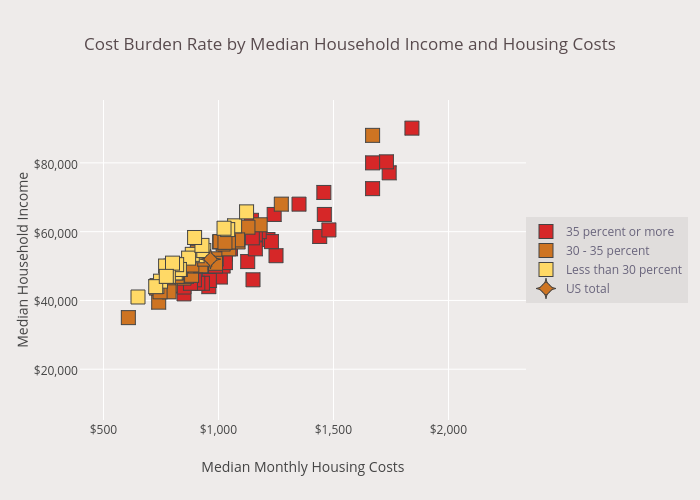

In our baseline scenario (where both rents and incomes grow in line with inflation, set at 2 percent), we find that demographic trends alone would raise the number of severely burdened renter households by 11 percent to 13.1 million. In addition to the baseline model, we run four alternative scenarios where annual income growth exceeds rent growth by 0.25 percentage point increments (topping out at 3 percent annual income growth versus 2 percent rent growth), as well as four scenarios where rent growth exceeds income growth in 0.25 percentage point increments. We find that for each ¼ increment in rent gains relative to incomes, there will an increase of 400,000 more severely burdened renters.

Under the most extreme case tested where rents outpace incomes by a full percentage point, we would see a 25 percent increase in cost burdened renters over the next decade. Conversely, for each quarter point gain in incomes relative to rents there would be a decrease in severely burdened renters of 360,000. But given the demographically-driven increases that are expected, even in the case that income growth is a full percentage point higher per year than rents, the number of severely burdened renters would only fall by 169,000 relative to today’s levels—hardly any progress at all.

Figure 1:

It’s also worth noting the unlikelihood that income growth will exceed rent growth by 1 percent every year for the next 10 years. Since 2001, changes in rents have consistently outpaced incomes, and that trend has only continued since the Great Recession. We do not anticipate income and rent trends to change drastically over the next 10 years, thus reducing the likelihood that the number of severely cost burdened renters will fall.

We also analyzed the distribution of impacted households by age, race/ethnicity, and household type. The baseline scenario highlights the significant influence of two broad demographic trends on housing affordability: the rapid aging of the population and the growing racial and ethnic diversity of younger households. When breaking the data out by age, the largest shares of burden would be among older adults and millennials. Among older adults, the number of severely burdened households aged 65-74 and those aged 75 and older are expected to rise by 42 percent and 39 percent respectively. These numbers illustrate a critical need for elderly housing and services that help individuals age in place.

Hispanic households are projected to have a 27 percent increase in severe renter burdens under the baseline scenario, which is the highest rate among any race/ethnicity. Given the Hispanic population’s projected growth in the U.S., this finding is not surprising. Following Hispanic households are Asians and other non-black minorities at 23 percent and non-Hispanic blacks at 11 percent, compared to only a 0.5 percent increase for white households. Hispanics account for a large share of gains in burdened households under all our scenarios, although if rents continue to grow faster than incomes, whites will account for a larger share of the rise. Under the most optimistic scenario where incomes grow faster than rents by a full percentage point, the number of severely burdened minority renters will still increase by 435,000, offsetting a small decline among white.

Finally, when analyzing the findings by household type, under all scenarios the largest growth rate is expected to be among married couples without children—attributable to the baby boomer–driven growth in older couples whose children have grown up and moved out. This is followed by the millennial-driven growth in the number of married couples with children, and the growth in single-person households, who account for the largest absolute increase in burdened households primarily driven by older adults who are more likely to live alone as they age.

Learn more about our findings in the full paper, Projecting Trends in Severely Cost-Burdened Renters: 2015-2025.