|

| by George Masnick Senior Research Fellow |

The latest release of Census Bureau 2014 population estimates for metropolitan areas underscores the existence of large differences in population growth among the nation’s large metros. The nation’s 100 largest metropolitan areas in 2014 are home to about two thirds of Americans. The largest of these is the New York-Northern New Jersey-Long Island metro at just over 20 million, and the smallest is Durham-Chapel Hill at about 550,000. If we compare population growth that took place during the first decade of this century with what has occurred more recently, we can see both the longer-term growth differences among metros and identify places where population growth has accelerated or declined between 2010 and 2014.

Figure 1 plots annual population growth in the 97 of the 100 largest metro areas in 2010 that also made this list in 2014. Most of the 97 metros cluster together at under 25,000 annual population growth for both periods, and are growing moderately, slowly, or not at all. Only a couple of dozen metros exhibit population growth that sets them apart. For these, the higher the population growth in 2000-2010, the higher the growth in 2010-2014. For example, the Houston-Sugarland-Baytown metro area added an average of 123,000 people per year in the decade 2000-2010 and 134,000 per year from 2010 to 2014. Dallas-Fort Worth-Arlington increased 126,000 annually during the 2000s and 124,000 annually so far this decade. New York-Northern New Jersey-Long Island grew at an annual rate of 124,000 during each period.

The diagonal red line separates the scatterplot into metros that grew at a faster numerical annual rate during 2010-2014 compared to 2000-2010 (above the line) from those that grew more slowly (below the line). Among other moderately-higher growth metros, Atlanta-Sandy Springs-Marietta, Phoenix-Mesa-Scottsdale, Riverside-San Bernardino-Ontario, and Las Vegas-Paradise have grown more slowly since 2010, while Los Angeles-Long Beach-Santa Ana, the DC-VA-MD-WV metro, and Miami-Fort Lauderdale-West Palm Beach have grown more rapidly. Some metros with moderate growth during the previous decade have begun to grow more rapidly and add 30,000 or more people per year during the first half of the current decade. In addition to San Francisco-Oakland-Hayward and Boston-Cambridge-Quincy, Seattle-Tacoma-Belleview, Denver-Aurora-Lakewood, San Jose-Sunnyvale-Santa Clara and San Diego-Carlsbad are on this list of metros with significantly increased population growth. These are also places with the greatest increases in housing prices.

The Charlotte-Gastonia-Concord metropolitan area is an outlier in how much slower its population has grown in the recent period compared to 2000-2010. Such a slowdown should be surprising since Charlotte was not hit by the Great Recession and the bursting of the housing bubble as much as other metros falling well below the red line in Figure 1. In fact, its faster growth during 2000-2010 stems primarily from a large (+26%) adjustment to its baseline 2010 census count. It is the only metro in the top 100 with such a large percentage adjustment, which the Census Bureau states could be "due to legal boundary updates, other geographic program changes, and Count Question Resolution action."

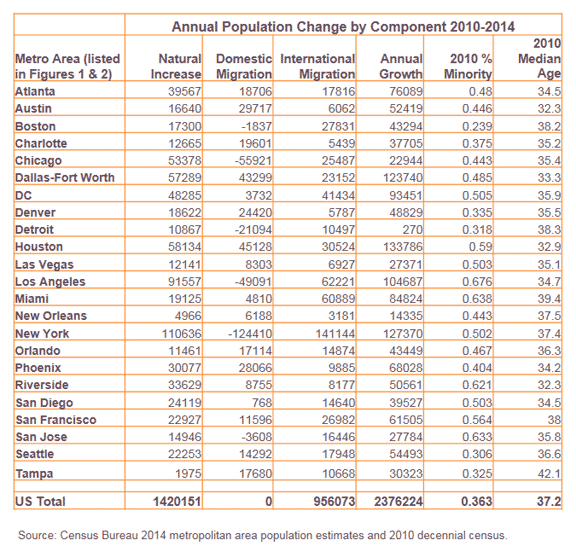

Decomposing population growth into its two broad components, net migration and natural increase (excess of births over deaths), allows us to better understand these recent metropolitan population growth trends. Figure 2 shows that the greater the net migration the greater the natural increase. Since migrants are generally young adults, metros that are migrant destinations have a greater excess of births over deaths. This is especially true of metros like Houston-Sugarland-Baytown, Dallas-Fort Worth-Arlington, DC-VA-MD-WV and Atlanta-Sandy Springs-Marietta, where both domestic and international migration are strongly positive (Table 1). Places that are retirement destinations like Miami-Fort Lauderdale-West Palm Beach, Orlando-Kissimmee-Sanford, and especially Tampa-St. Petersburg-Clearwater, have much lower rates of natural increase (fewer births and more deaths) because of their older age structures.

New York-Northern New Jersey-Long Island is an outlier, with its high level of international immigration largely being offset by domestic outmigration (annually 141,000 and -124,000 respectively during 2010-2014). But the New York metro’s high share of minority population (50.2 percent according to the 2010 census) produces a large growth from natural increase because of younger age structure and above-replacement fertility for minorities. Los Angeles-Long Beach-Santa Ana’s profile is similar to New York’s in that levels of recent annual international in-migration are offset by high levels of domestic migration losses (62,000 and -49,000 respectively), and its high natural increase is fueled by its minority population (67.6 percent in 2010). The Chicago-Naperville-Elgin metro area has recently experienced more than twice the level of domestic out-migration than immigration according to Census Bureau estimates. Still, Chicago’s minority population (46 percent in 2010) produces a significant level of natural increase, which has kept the Chicago metro’s overall population growth positive.