|

| by Daniel McCue Senior Research Associate |

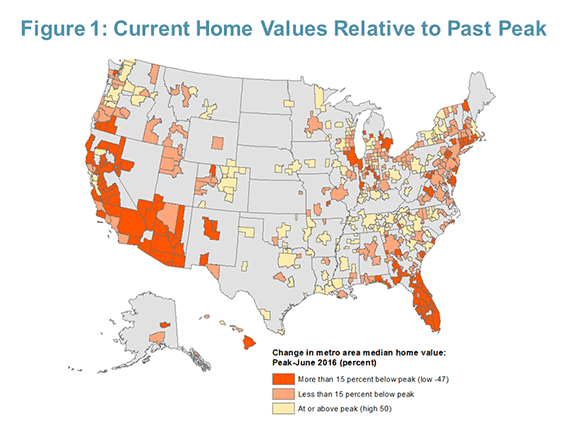

At the positive end, some metros have done far more than just recover, with home values rising above past peaks (Figure 1). A few of these metros are hot markets where home values have skyrocketed after substantial declines during the downturn. Examples include San Jose and San Francisco where median home values are now significantly above mid-2000s peaks, following significant declines in the late 2000s. Honolulu and Portland, OR experienced similar trends. However, these four metros are the exceptions, as the majority of metros with above-peak values have not seen particularly strong recent price appreciation and are mostly benefitting from their relatively minor price declines during the downturn. In fact, among the fifteen metros where current home values most exceed past peaks, five had total peak-to-trough declines of less than 3 percent. Five others had declines of less than fifteen percent, which was still well below the US nationwide peak-to-trough decline of 22.4 percent.

Having had a minimal downturn is perhaps the best indicator of whether or not a metro area’s current home values are back above mid-2000s peaks. The top thirteen metros with the smallest peak-to-trough declines in home values over the housing downturn are all fully recovered. These areas were mostly smaller metros located in the Southeast, Midwest, and upstate New York with a history of moderation in home prices. Conversely, the top 24 metros with the largest peak-to-trough declines in home prices during the downturn have uniformly failed to reach their past peak values as of June 2016. Indeed, among the twenty four metros with the largest decreases in home values during the downturn, none have fully regained their peaks. Outside of Detroit, these metros are exclusively located in the West (California and Arizona) and in Florida.

Metros such as Little Rock and Syracuse are at the top of the list relative to past peaks, but are these really the strongest markets for home values? Many areas with the steepest declines since the mid-2000s were also those with the largest run-ups in home values, and the net sum in many cases is still a significant net increase since 2000. Looking at home values relative to year 2000 instead of mid-2000s peaks, we find many of the metros with the highest appreciation since 2000 to be those where home values are still well below peaks from 2005 and 2006 (Figure 2). Meanwhile, many of the slow-growth metros where home values are highest when measured relative to peaks, such as Little Rock and Syracuse, have seen much lower net price appreciation over the longer period.

There are several possible takeaways from this analysis:

- The housing recovery has been uneven across metro areas. While home values in the US are approaching past peaks, two thirds of metro areas are still below past peak levels from the mid-2000s.

- Whether or not home values in a metro area have recovered to past peak levels depends on the size of the downturn in that metro.

- Metros with the largest downturns, as a group, are seeing high rates of appreciation in recovery, but the majority have not yet recovered big losses and are still below past peaks.

- Being below past peaks does not mean home values are low. In metros where home values are currently furthest below mid-2000s peaks, home values are still well above levels from 2000.

- In many of the metro areas that are still well below mid-2000s peaks, net appreciation in home values since 2000 has actually been greater than in areas currently well above mid-2000s peaks that have had more modest rates of appreciation.

Overall, this data appears to suggest a trade-off between risk and return playing out across metropolitan area home values in the US. The high levels of appreciation since 2000 in the highest-growth areas have come with extreme volatility and the need to ride out the downturn successfully. Indeed, one cannot discount the significant housing wealth lost with the downturns, and the fact that those benefitting from recent recovery in prices are not always those who lost out in the downturn. However, while they have received more modest appreciation in home values since 2000 relative to those in high growth areas, homeowners in low-growth areas have not missed out on the ability to build wealth through housing either. Perhaps for many, the moderation of downside in these metros makes their modest housing appreciation look more appealing.

No comments:

Post a Comment